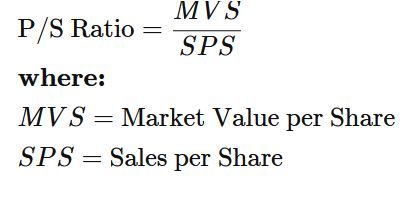

The price-to-sales (P/S) ratio is a valuation metric that compares the stock price of a business to its revenue. It’s a measure of how much the financial markets value each dollar of a company’s sales or profits.

Divide the stock price by the underlying company’s sales per share to get the P/S ratio. A low ratio may suggest that the stock is cheap, while a high ratio may indicate that the stock is overpriced.

One disadvantage of the P/S ratio is that it ignores whether the firm generates any earnings or will generate earnings in the future.

The item is defined as the close price of the stock divided by the revenue per share of the company for the most recent financial year. The ratio indicates the number of units of stock price to be expended to purchase 1 unit of revenue per share. Suppose revenue of the company is Rs.100,000, shares outstanding is 500 and the stock price is Rs.100. PS ratio is calculated as 100/ (100,000/500) = 0.5x. So it costs Rs. 0.5 to purchase every Rupee of the company’s revenue

PS ratio is a valuation ratio and is used in lieu of the PE ratio. When a company is loss-making, EPS becomes negative and calculating PE ratio is not possible. In such a scenario PS ratio can be used. Just as in PE ratio, PS ratio is used by comparing the ratio of 2 or more companies operating in the same sector. The lower the ratio, the more undervalued the company. However one has to understand the reasons behind undervaluation before deciding whether the stock has investment potential