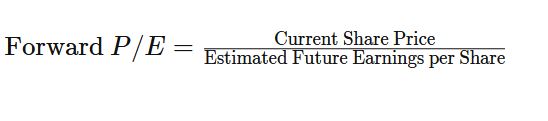

The future price-to-earnings (forward P/E) ratio is a variation of the price-to-earnings (P/E) ratio that employs anticipated earnings to calculate the P/E. While the earnings utilized in this method are only estimates and not as accurate as current or historical earnings data, projected P/E analysis still has value.

Because forward P/E is calculated using anticipated earnings per share (EPS), it may provide inaccurate or biased results if actual earnings differ.

To make a better judgment, analysts frequently blend future and trailing P/E forecasts.

The forward P/E ratio differs by projecting, or estimating, a company’s likely earnings per share for the next 12 months. The forward P/E ratio is favoured by analysts who believe that investment decisions are better made based on estimates of a company’s future rather than past performance. Estimates used for the forward P/E ratio can come from either a company’s earnings release or from analysts

While calculating forward P/E, there are two implicit assumptions:

-

That the total capital structure is unaltered - namely that the number of equity shares outstanding remains the same for this forward period

-

That net earnings are projected / extrapolated or some guidance is available for the company. Usually, analysts who track a company or a sector make statements on how these earnings might behave in the future, given macro and micro trends plus historic company growth rates, the known business pipeline of the company (order book, retail expansion footprint etc.), the known initiatives the company is taking (increased automation, cost cutting etc.)