A payroll officer needs to do careful planning. There are always ongoing tasks that need attention and a constant need to monitor changes to withholdings, contribution to social security funds, etc. The entire process can be split into three stages, pre-payroll, actual payroll and post payroll activities.

Pre-Payroll Activities

Defining Payroll Policy

The net amount to be paid is affected by multiple factors. The company’s various policies such as pay policy, leave and benefits policy, attendance policy, etc. come into play at that time. As a first step, such policies need to be well defined and get approved by the management to ensure standard payroll processing.

Gathering Inputs

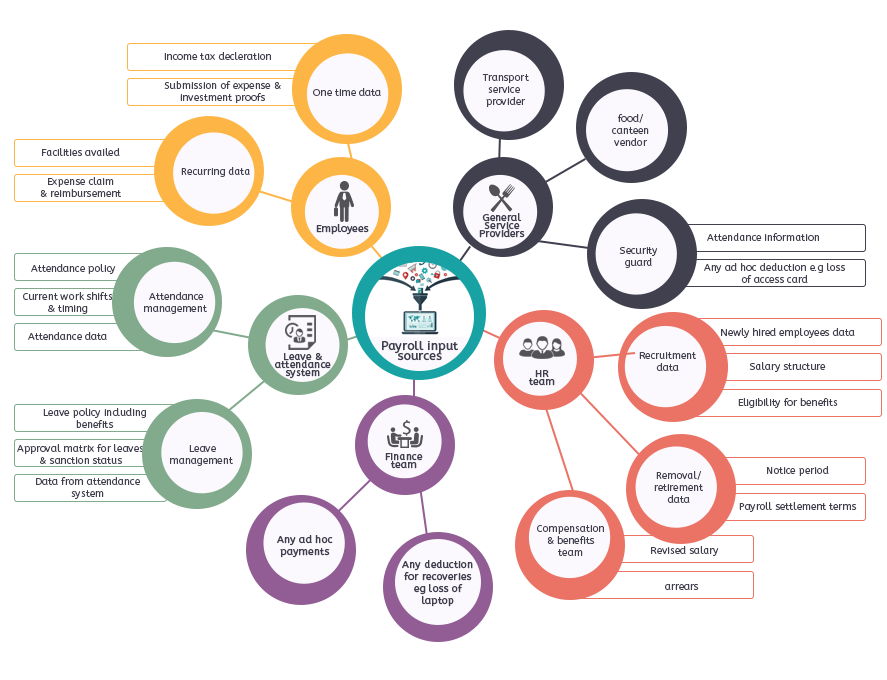

Payroll process involves interacting with multiple departments and personnel. There can be information like mid-year salary revision data, attendance data, etc.

In smaller organizations, these inputs are received from a consolidated source or fewer teams. However, in a larger organization, the task of gathering data may look overwhelming. If you are using a smart payroll software having integrated features like leave and attendance management, employee self-service portal, etc. inputs collection process does not remain a problem.

Input Validation

Once inputs are received, you need to check for validity of the data concerning adherence to company policy, authorization/approval matrix, right formats, etc. You also need to ensure that no active employee is missed out and that no inactive employee records are included for salary payment. Read top 6 payroll validations to ensure accurate payroll.

Actual Payroll Process

Payroll Calculation

At this stage, the validated input data is fed into the payroll system for actual payroll processing. The result is the net pay after adjusting necessary taxes and other deductions. Once payroll process is over, it is always a good practice to reconcile the values and verify for accuracy to avoid any errors.