IT0003 is used to define the current payroll status of the employee like released, exit etc. We can lock the personnel number using the IT0003.

It automatically stores data that controls the employee’s Payroll run and time evaluation. It is created automatically by the system, in the background, during the Hiring Action.

Payroll mistakes can happen faster than you think. For a moment, think about the employees for whom monthly salary is the only source of income. Imagine what if the salary is not paid accurately or there is a delay in releasing salary. Such irregularities can take a toll on the morale of the employees and ultimately affect the business productivity.

While ensuring accurate and timely payment of salary is important, adhering to the various laws and regulations such as labor law, PF, PT and other statutory compliance is also critical. Non-adherence with these laws can attract serious legal and financial consequences.

To make sure that your employees are happy and you are law compliant, you need to have a proper understanding of what payroll is and how to run payroll effectively. We will start with the basics of payroll.

What is Payroll?

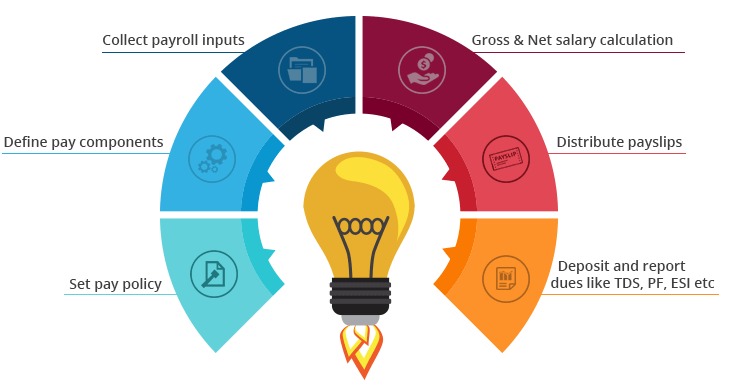

Payroll is a list of employees who get paid by the company. Payroll also refers to the total amount of money employer pays to the employees. As a business function, it involves:

- Developing organization pay policy including flexible benefits, leave encashment policy, etc.

- Defining payslip components like basic, variable pay, HRA, and LTA

- Gathering other payroll inputs (e.g., organization’s food vendor may supply information about the amount to be recovered from the employees for meals consumed)

- The actual calculation of gross salary, statutory as well as non-statutory deductions, and arriving at the net pay

- Releasing employee salary

- Depositing dues like TDS, PF, etc. with appropriate authorities and filing returns

In short, we can say that payroll process involves arriving at what is due to the employees also called as ‘net pay’ after adjusting necessary taxes and other deductions.

The equation for calculating the net pay

Net pay = Gross income- gross deduction

Where,

Gross income or salary = All types of regular income + allowances + any one-time payment or benefit

Gross deduction = All types of regular deductions + statutory deductions + any one-time deductions

SQL

SQL

HTML/CSS/JS

HTML/CSS/JS

Coding

Coding

Settings

Settings Logout

Logout