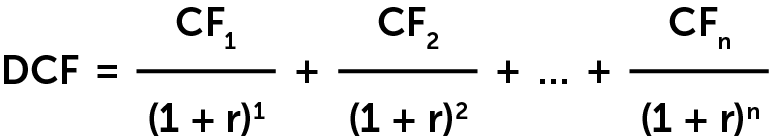

Here’s the basic formula for a simplified DCF analysis:

-

DCF—Discounted cash flow, which is the sum of all future discounted cash flows that an investment is expected to produce

-

CF—Cash flow for a given year

-

r—Discount rate, or the target rate of return on the investment expressed in decimal form

Keep in mind, there are a wide range of formulas used for DCF analysis outside of this simplified one, depending on what type of investment is being analyzed and what financial information is available for it. This formula is simply meant to highlight the general reasoning used in the process.